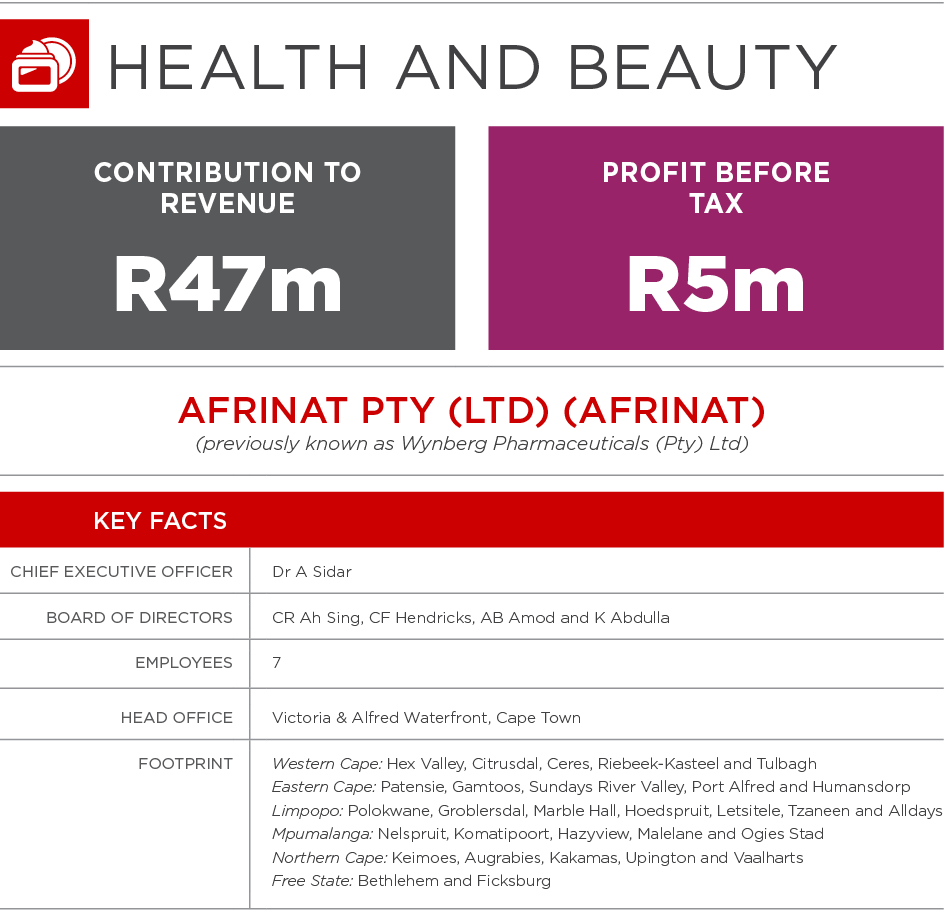

Health and Beauty

PROFILE

AfriNat supplies a range of natural biostimulants and agricultural pre-harvest products as well as a range of cleaning solutions under the brand ViBacSan® to the post-harvest industry and hygiene and sanitation sector. These products are human, animal and plant safe, internationally recognised and certified as such, using British and European Standards (BS, ES), National Regulatory Compulsory Specifications (NRCS) and SABS. Agricultural products are registered with the Department of Agriculture, Forestry and Fisheries (DAFF) and have the NSF International accreditation.

The products are registered and manufactured locally and are being used with success in the agricultural, food, and general health and hygiene sectors. AfriNat acquired the intellectual property (IP) from a UK-based company called Phyto, and is currently in a joint venture with them providing access to their other products for select markets.

Over the last 18 months the strategic objectives were changed to focus in South Africa and Southern Africa.

2018 OPERATIONAL PERFORMANCE

AfriNat operates in three sectors: pre-harvest, post-harvest, and hygiene and sanitation with different ranges of products. The biggest growth came from the pre-harvest sector due to increased market share from the Eastern Cape and Northern Cape. Pre-harvest exceeded budget, however, with the other two divisions not meeting their budgets the overall performance is marginally below budgeted expectations.

Strategic objectives in post-harvest and hygiene and sanitation have been put in place to address the underperformance and are starting to show results. The biggest challenge is the change in thinking required to use their product ranges as pricing versus application and the effect is different to conventional products. This requires extensive marketing efforts which the Company has not engaged in fully, but has planned it strategically for the new year. This entails food preparation companies and shopping mall property companies to offer a high-efficacy, cost-saving solution.

AfriNat delayed the introduction of food additives and preservatives and rather focused its efforts on the current divisions. However, diversification into the food sector is critical to avoid the risks of the drought and the cyclical nature of the agricultural market. This is largely mitigated by the current research and development projects underway in the food sector. The Company has engaged with manufacturers to establish its market presence and hopes to see the results in the new year.

VISION 2020 VISION – AFRINAT’S CONTRIBUTION

A detailed analysis of the business was done in 2015 and a five-point strategic plan was implemented in 2015 with clear deliverables, strategic actions for each strategic level as well as clear time frames.

2018 Achievements:

- They moved from research to commercialisation of products into the agricultural sector.

- The introduction and successful registration of additional products to the original 15 products in the ViBacSan® range have been subjected to independent evaluation and trials, establishing the credentials of the product in local markets. New regulatory submissions to the NRCS are currently in progress. A test trial, on two ViBacSan® products was successful at the GLP Laboratory “Micro-Challenge” overseas and AfriNat was granted the ACT 5 Registration Number by the NRCS for these two products.

- The introduction of pre-harvest products to the local market has been extremely successful with farmers. The products, through delivery of a spray programme, have shown benefits of increased health and thus crop yield increases. All DAFF registrations for pre-harvest products have been successfully accomplished.

- The post-harvest products will add to the value chain in the agricultural sector. These are part of the products mentioned in point 2 above and used in the processing following harvest and picking. Packhouses are the primary customer and AfriNat is actively signing agents and distributors in various regions to actively promote the range. This gives packhouses the opportunity to meet international standards on food safety in the export of fruit and vegetables.

- Growth in the hygiene and sanitation sector is being developed through cleaning contractors and large property companies. They offer a natural water-saving alternative to end-users which is in line with international trends. This is in addition to the food preparation business showing steady acceptance. Food ingredients and preservative aspects are still in the research and development phase, having conducted multiple tests in food and fish plants.

PROSPECTS AND FUTURE OUTLOOK

AfriNat has developed a platform for growth which is estimated at 25% per annum based on the uptake of the product offering over the next three years. They have seen an almost 200% growth in the pre-harvest division this year through active marketing efforts and with additional distributors being signed on in different provinces. There are no planned acquisitions in the short to medium-term and organic growth is expected by increasing market share and penetration into both the pre-harvest and post-harvest markets.

The main opportunity that exists is the international focus on a green economy and protecting the environment as AfriNat has acquired the rights to internationally recognised natural products supporting key industries that impact on the health and well-being of the population. These products range from domestic hygiene to food security.

The following prospects have been identified in reaching their Vision 2020 Vision:

- Growth of the product portfolio in pre-harvest – the opportunities to capitalise on their empowered status and successfully attract international and local partners to expand their product portfolio

- Discussions with multiple international companies to have trade relations supplying products and, in turn, having exclusivity on their products in South Africa in the pre-harvest sector

- The food and beverage manufacturing and processing sector has been delayed for active entry until the 2018–2019 fiscal year due to the intense focus and demand from the agricultural sector

- Conclude a local manufacturing facility – this initiative will provide jobs locally and require the transfer of new skills to employees

- Diversity of products and market – AfriNat is embarking on a possible public private partnership with local municipalities and provincial governments to establish centres of excellence to provide support to emerging farmers

- Expansion into new sectors with innovative products – a significant opportunity exists to capture a large portion of the infection control and hygiene and sanitation markets in the health delivery system, as well as the food processing and hospitality sectors with their internationally recognised, totally natural range of sanitation and hygiene products

- Retention of business won – in a business environment that is based on a high level of relationship building, the successful retention of business won on this basis is a key measure of AfriNat’s performance

- Expand into new markets outside of South Africa

OPERATIONAL FOOTPRINT

AfriNat’s administrative function which includes management, marketing and finance operates from the V&A Waterfront, Cape Town. Manufacturing is done under agreement with a contract manufacturer in Blackheath, Cape Town. The distribution of products is done under distribution agreements with vendors in the respective sectors and provinces.

PRODUCTS/BRANDS

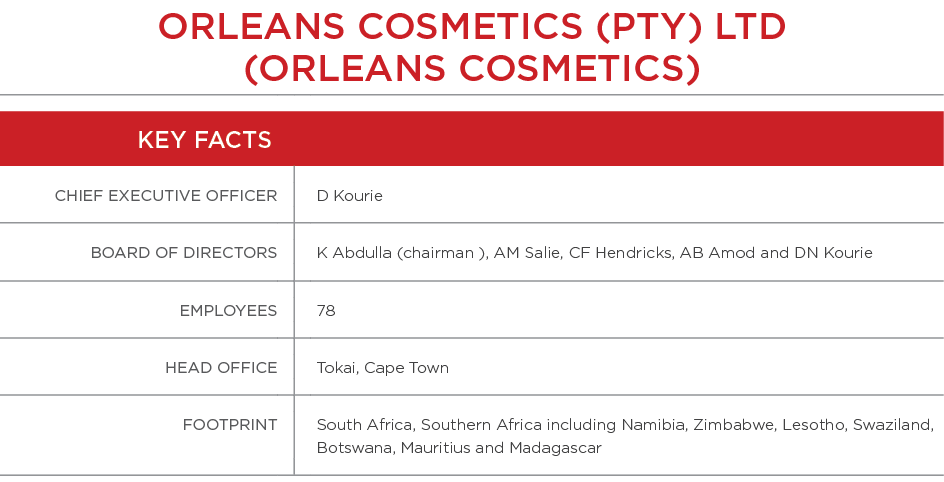

PROFILE

Orleans Cosmetics (Pty) Ltd was acquired in May 2017 and became a subsidiary of AEEI. It was a business previously known as Orleans Distributors CC and RVB Cosmetics CC, which had been in business in South Africa for the past 22 years.

Orleans Cosmetics imports and distributes four cosmetic brands from Europe on an exclusive basis in South Africa and neighbouring territories, through retailers and beauty salons.

Orleans Cosmetics is the exclusive Southern Africa distributor of the following imported cosmetic brands, each one with a long international history:

- Gatineau – founded in France in 1932

- NUXE – founded in France in 1990

- RVB Skinlab/Diego Dalla Palma Professional – founded in Italy in 1961

- Sothys – founded in France in 1946

Gatineau and NUXE are sold in retailing groups such as Truworths, Woolworths and Edgars, while Gatineau is sold in Dis-Chem. Both brands are also sold in beauty salons.

RVB Skinlab/Diego Dalla Palma Professional and Sothys are exclusively found in beauty salons and spas across South Africa.

The Company’s present focus is on skincare with an emphasis on anti-ageing. The business has a make-up range in RVB/Diego Dalla Palma.

2018 OPERATIONAL PERFORMANCE

The acquisition of Orleans Cosmetics in the prior year, combined with the existing business has led to revenue increasing by 258% from R9.7m to R34.5m, mainly as a result of the financial results being including for twelve months compared to only four months in the prior year.

VISION 2020 VISION – ORLEANS COSMETICS CONTRIBUTION

Orleans Cosmetics vision is to be a leading player in the prestige and masstige cosmetics industry in both the retail industry and in beauty salons. It intends to acquire fragrance lines and additional make-up brands to complement its current skincare ranges.

2018 Achievements:

- Focused on strengthening the brand’s presence in the marketplace

- Explored the possibility of obtaining additional agencies in fragrance

- Explored the possibility of obtaining additional make-up brands

PROSPECTS AND FUTURE OUTLOOK

The chief executive officer of Orleans Cosmetics has a vast amount of experience in this industry having worked with major brands for many years. As a result, he understands the industry very well and is well placed to drive the future growth of the business.

The key drivers in the business are the following:

- Superb customer service at point of sale through their dedicated, highly trained beauty consultants and the extremely well-qualified beauty therapists employed by the salons

- Training of store consultants and beauty salon therapists

- Close strategic relationships with key retailers

- Excellent management at head office and in the field, being the area managers

- Public relations and marketing

OUTLOOK FOR 2019

- Continue to focus on strengthening the brands’ presence in the marketplace

- Launch exclusive agencies in fragrance – an experienced fragrance brand manager has been appointed with effect from 1 October 2018

- Launch make-up which is subject to retailer’s approval

Orleans Cosmetics intends to double the size of its business within the next four to five years. Growth will occur through a balance of organic growth and acquisitions.

The business was previously owned and managed by the Neilson family for 21 years. The intention is to retain the entrepreneurial spirit which already exists and to blend this with the business expertise which AEEI can provide. The Company has built a solid reputation over the years as being professional, well managed and responsive to the needs of its end customers and to the retailers and beauty salons.

As a subsidiary of AEEI, Orleans Cosmetics is very well positioned to be the partner of choice for both local companies and to represent overseas brands due to AEEI’s B-BBEE credentials.

Industry statistics indicate that the luxury and masstige segments of the cosmetics market are in excess of R6bn per annum at retail prices and there is enormous potential growth for Orleans Cosmetics.

OPERATIONAL FOOTPRINT

Orleans Cosmetics has the exclusive distribution rights from the four overseas-based principals for South Africa and Namibia, and in certain cases it also has the rights to Mauritius, Madagascar, Zimbabwe, Mozambique, and Swaziland.