About this report

African Equity Empowerment Investments Limited (AEEI, the Company or the Group) is committed to the principles of integrated reporting in terms of our thinking and our approach to long-term value creation and the role we play as a corporate citizen.

This integrated report is our primary report to stakeholders.

Our 2018 integrated report follows on our Vision 2020 Vision as reported on in the 2017 integrated report. It aims to provide a balanced, accurate and accessible assessment of our strategy, performance and opportunities and how these relate to material financial, economic, social, environmental and governance matters. These matters form the anchor of the content throughout this report.

The Group’s leadership develops and directs the strategy and manages the business in an integrated way. Management takes into account the interests of our stakeholders and is cognisant of capital resources required to realise the strategy.

To ensure that the contents of this integrated report are aligned with material matters impacting our ability to create value, we were guided by the following in preparing our report:

- The International Integrated Reporting Council’s (IIRC) Integrated Reporting <IR> Framework

- King IV Report on Corporate Governance™ for South Africa 2016 (King IV™)

- The Johannesburg Stock Exchange (JSE) Listings Requirements

- The International Financial Reporting Standards (IFRS)

- The Companies Act, 2008 (No. 71 of 2008), as amended (the Companies Act)

- The Global Reporting Initiative (GRI) G4 Guidelines

- Broad-based Black Economic Empowerment (B-BBEE) Regulations

Scope, boundary and reporting cycle

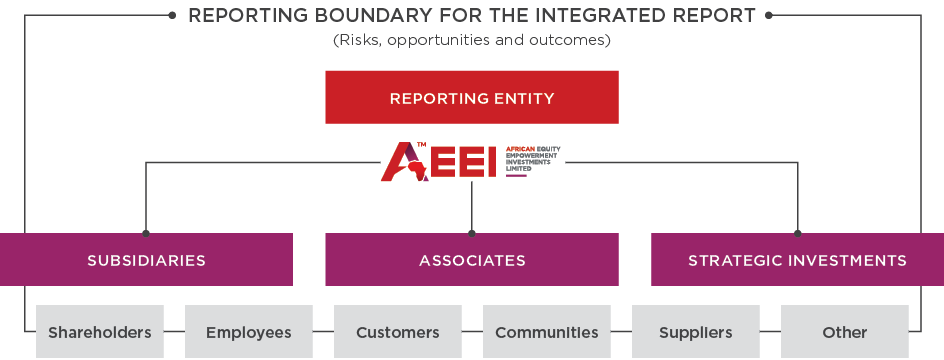

Our integrated report covers the performance of the Group for the financial year ended 31 August 2018 as well as the material information related to the strategy, business model, governance, material matters and creating shared value, shareholders’ interests, and our future outlook. It also incorporates the financial reporting boundary of the Group and its subsidiaries. This report extends beyond financial reporting and includes non-financial performance, opportunities, risks and outcomes attributable to or associated with our key stakeholders.

The Group’s income is generated mainly in South Africa, with 29% generated from Asia, Europe, Dubai, Saudi Arabia, the United Kingdom (UK), the United States of America (USA), Ghana, Uganda, Zambia, Cameroon, Tanzania, Nigeria, Namibia, Kenya, Zimbabwe, Botswana, Spain, Ethiopia, Lesotho, Swaziland, Mozambique, Madagascar, Malawi and Mauritius. This report aims to enable our readers to obtain a balanced view and to make an informed assessment of the Group’s ability to create stakeholder value in the short, medium and long-term.

Materiality and material matters

AEEI applied the principle of materiality in assessing which information is to be included in this report. Hence, this report focuses particularly on those matters and provides material information which relates to the Group’s strategy, governance, performance and sustainability in respect of all business units and sectors, which comprise food and brands, technology, events and tourism, health and beauty, biotherapeutics, and strategic investments. All non-financial indicators include subsidiaries but exclude associates and strategic investments unless specifically indicated. Through a formal process the Board committees and executive management identified material matters, and in terms of relevance these were approved by the Board. Material matters and developments are comprehensively dealt with throughout the report. Our material matters influence our strategy and inform the content of this report.

Combined assurance and internal control framework

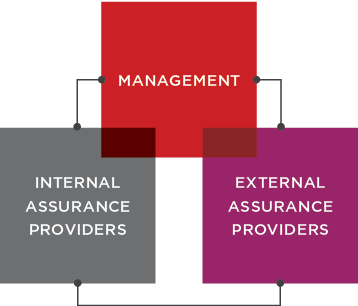

AEEI has a combined assurance model, which includes internal and external assessments of key strategic risks, internal controls and other material areas to support the integrity of the management, monitoring and reporting data.

The Board paid attention to the combined assurance through the audit and risk committee, which ensured that our combined assurance model adequately addresses the Group’s risk and material matters. We continually look at optimising our combined assurance model to avoid duplication of efforts, rationalise collaboration efforts and manage assurance costs. This enables an effective control environment and ensures the integrity of the information used for reporting and decision-making.

Combined assurance

The Board, with the support of the audit and risk committee, is ultimately responsible for the system of internal control, which is designed to identify, evaluate, manage and provide reasonable assurance against material misstatement and loss. The audit and risk committee applied the combined assurance model to seek and optimise the assurance provided by management, the internal auditor and external assurance providers to ensure a strong ethical climate and to ensure compliance. They also monitored the relationship between the external assurance providers and the Company.

The Board approved the risk management policy during the year under review and through this process management identified key risks and implemented the necessary internal controls. This process is regularly evaluated and monitored by the internal audit team. The external audit covers accounting matters and controls during their audit.

Management provides the Board with assurance on its accountabilities in terms of implementing and monitoring the Group’s risks register and plan, as well as the controls related to the Group’s day-to-day activities, while fostering a strong ethical climate to ensure compliance.

As AEEI is listed on the JSE, it complies with the JSE Listings Requirements, the Companies Act and King IV™.

Certain information included in this report has been externally assured and reviewed including the following:

- The integrated report was reviewed by our external auditors, BDO Cape Inc.

- The consolidated and separate annual financial statements for the year ended 31 August 2018 were audited by BDO Cape Inc.

- External verification has been provided for the Broad-based Black Economic Empowerment (B-BBEE) accreditation level. The verification was carried out by an organisation accredited by the South African National Accreditation System (SANAS) – the Accreditation for Conformity Assessment, Calibration and Good Laboratory Practice Act, 2006 (Act No. 19 of 2006).

- External verification on the integrated report and the consolidated and separate financial statements for the year ended 31 August 2018 was performed in terms of the JSE Listings Requirements and the Companies Act.

- This integrated report was not subject to an independent audit or review.

- The sustainability review has not been independently assured, however, certain information contained in this review has been scrutinised by the Group’s own internal control functions.

The information reported on is derived from the Group’s own internal records and information available in the public domain.

The Board reviewed the effectiveness of controls for the year ended 31 August 2018, principally through a process of management self-assessment, including confirmation from executive management. It also considered reports from the internal audit, the external auditor and other assurance providers. (King IV™ – Principle 5)

Significant changes during the reporting period

The Group successfully listed its technology division – now trading as AYO Technology Solutions Ltd (AYO) – on the main board of the JSE on 21 December 2017. Subsequent to the listing, AYO became an associate on 24 August 2018 as AEEI now owns 49.36% of AYO.

AEEI through its investment in AEEI Events and Tourism, acquired an additional 24.5% shares from a shareholder in espAfrika (Pty) Ltd by exercising its pre-emptive rights, whereafter their shareholding ceased to exist.

During the financial year an impairment was raised on the intangible assets as well as goodwill of Genius amounting to R140m, as a result of the carrying amount of these intangible assets exceeding its recoverable amount, as a result of the cash generated from these assets.

The Group, through its subsidiary Premier Fishing SA (Pty) Ltd, acquired a 50.31% stake in Talhado Fishing Enterprises (Pty) Ltd (Talhado). All conditions precedent were met during the period under review. Talhado is the largest squid player in the South African market and this strategic acquisition is in line with the Group’s strategy to diversify by expanding organically and through acquisitions.

POSt balance sheet events

Subsequent to year-end, on the 9 November 2018, the Board approved a buyback of its shares, which management believe is trading at a discount to net asset value (NAV), thereby creating shareholder value.

A final gross dividend of 12.00 cents per share has been declared after the reporting period but before the financial statements were authorised for issue.

The directors are not aware of any other material facts or circumstances which occurred between the statement of financial position date and the date of this report that would require any adjustments to the annual financial statements.

DIRECTORS’ RESPONSIBILITY AND APPROVAL OF THE INTEGRATED REPORT

The AEEI Board is ultimately responsible for ensuring the integrity of the integrated report and acknowledges its responsibility to ensure that the integrity of the integrated report is not compromised. The audit and risk committee also reviewed and recommended the integrated report and annual financial statements to the Board for approval. The Board has applied its mind to the integrated report and believes that it addresses all material matters and fairly represents the integrated performance of the Group.

The integrated report and the annual financial statements for the Group for the year ended 31 August 2018 were approved by the Board of directors and signed on their behalf by Reverend Dr VC Mehana and Mr K Abdulla on 26 November 2018. (King IV™ – Principle 15)

The special resolutions passed during the year for the Company relate to the approval:

- of the remuneration for executive and non-executive directors;

- for inter-company financial assistance;

- of financial assistance for the acquisition of shares in a related or interrelated company; and

- for the Company or its subsidiaries to repurchase Company shares.

DISCLAIMER: FORWARD-LOOKING STATEMENTS

In this report we make certain statements that relate to analyses and other information based on forecasts of future results based on historical data, which are based on estimations of new business and investment assumptions. These statements may also relate to our future prospects, developments and business strategy. As defined, these are forward-looking statements. These statements may be identified by words such as “expect”, “look forward to”, “anticipate”, “intend”, “plan”, “believe”, “seek”, “estimate”, “will”, “project” or words of similar meaning which are intended to identify such forward-looking statements, but are not the exclusive means of identifying such statements. These are subject to a number of risks, uncertainties and factors, including, but not limited to, those described in disclosures and in the risk management report.

Should one or more of these risks or uncertainties materialise or should underlying expectations not occur or assumptions prove incorrect, actual results, performance or achievements of AEEI may (negatively or positively) vary materially from those described explicitly or implicitly in the relevant forward-looking statement. AEEI neither intends nor assumes any obligation to update or revise these forward-looking statements in light of developments that differ from those anticipated.

We welcome your feedback and comments on the integrated report. Please address any queries to the corporate affairs and sustainability director, Cherie Hendricks at [email protected].