Corporate governance report

At AEEI we believe that effective corporate governance is critical to delivering on our Vision 2020 Vision strategic objectives and creating long-term value for our shareholders. As well as implementing minor improvements in governance, our governance framework is clear and consistent in terms of delegation of authority from our Board of directors to senior levels within our Group.

STATEMENT OF COMMITMENT

The Board is committed to the highest standards of ethics, governance and business integrity and has adopted an integrated approach to managing the Group to ensure that the governance structure actively identifies, communicates on and responds to material matters that impact on the Group’s capacity to create value. The Board believes that it has addressed all material matters appropriately and that it fairly represents the integrated performance of the Group. The Board continuously reviews the Group’s governance structures and processes to incorporate and accommodate new corporate developments, to facilitate effective leadership, to provide sustainable corporate citizenship in support of the Group’s strategy and to reflect national and international corporate governance standards, developments and best practices. (King IV™ – Principle 6)

The Board is satisfied that effective controls have been implemented and complied with throughout the Group and that the Company fully complies with the spirit and form of the continuing obligations of the JSE Listings Requirements, King IV™ and the Companies Act.

CREATING VALUE THROUGH SOUND CORPORATE GOVERNANCE

Sound corporate governance and ethics form the foundation of AEEI’s business and are pivotal in delivering long-term value to our stakeholders. AEEI has a positive association with all its stakeholders and is committed to the highest standards of ethics and business integrity in all its activities.

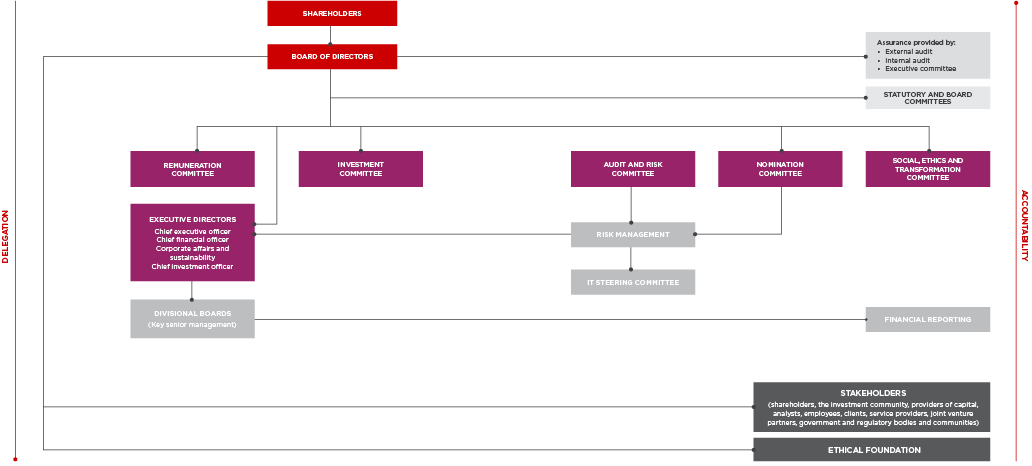

OUR GOVERNANCE FRAMEWORK

The Board is the principal decision-maker and is supported by various committees and the executive management team. The Board is responsible for the strategic direction of the Group and the Company’s governance framework. The governance framework supports the Company’s strategic focus areas.

The Board plays a pivotal role in strategy planning and has established clear benchmarks to measure the strategic objectives of the Company. The Board ensures that its sound governance framework will enhance good corporate governance, improve internal controls and improve the Company’s performance. In carrying out the Company’s strategic objectives, the Board is assisted by the necessary committees, including the executive committee, with clear terms of reference to assist the Board in discharging its responsibilities. This flows down to the subsidiaries and divisional levels to ensure that the business is provided with a structure within which management can operate effectively.

The Group’s governance framework focuses on the following:

- Vision, strategy and performance

- Ethical and responsible leadership

- Finance, including budgets and forecasts

- Corporate citizenship

- Risk management

- Information technology

- Investment

- Products – quality, cost, delivery and competitiveness

- Human capital – health, safety, employee wellness and the environment

- Transformation

- Sustainability

- Stakeholder relations

As AEEI is listed on the JSE, the Company is subject to and has implemented controls to provide reasonable assurance of compliance with all relevant regulatory requirements in respect of its listing. AEEI has applied all the principles of King IV™. (King IV™ – Principle 6)

ETHICAL AND RESPONSIBLE LEADERSHIP

The Board provides effective leadership based on a principled foundation and the Group subscribes to the highest ethical standards. Responsible leadership, instilled by the values of responsibility, transparency, accountability and fairness, has been a defining characteristic of the Company since inception.

AEEI’s fundamental objective has always been to do business ethically while building a sustainable Company that recognises the short and long-term impacts of its activities on the economy, society and the environment.

The Group is governed by its Code of Ethics and Code of Conduct. The Code of Ethics requires all directors, management and employees to obey the law, respect others, to be honest and fair and to protect the environment. The Code of Conduct articulates AEEI’s commitment to doing business according to best practices, the right way and guided by our values. (King IV™ – Principles 1 and 2)

The Board comprises 10 directors of whom six serve as non-executive directors and four as executive directors. The Board is satisfied that its composition contains the appropriate knowledge, skills, experience, independence and race and gender diversity. The Board operates in terms of a board-approved charter and there is a clear division of responsibilities at Board level to ensure a balance of power and authority. No one individual has unfettered powers of decision-making.

At the AGM on 21 February 2018, Mr Salim Young did not make himself available for re-election as a member of the Board and as a member of the audit and risk, remuneration and investment committees.

The Board reviewed the current membership composition and appointed Mr Abdul Malick Salie as an executive director in the capacity of the chief investment officer, and Advocate Dr Ngoako Ramatlhodi as the lead independent non-executive director to the Board.

The Board is satisfied that it has discharged its duties and obligations as described in the Board Charter during the year under review.

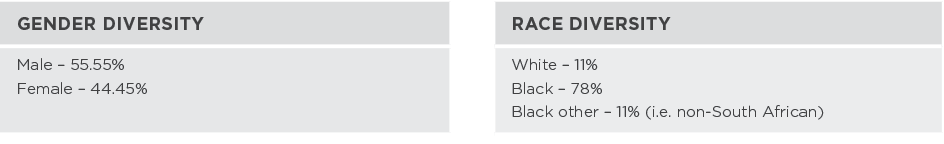

BOARD COMPOSITION – GENDER AND RACE DIVERSITY

APPOINTMENTS TO THE BOARD

In terms of the Company’s Memorandum of Incorporation, all directors retire by rotation with the exception of directors appointed as executive directors or as an employee of the Company or any other capacity will not be subjected to retirement by rotation while holding such position.

Non-executive retiring directors offer themselves for re-election by shareholders at the Company’s AGM. In addition, the appointment of any new director will be confirmed by shareholders at the first annual general meeting (AGM) following such appointment.

Executive directors do not have fixed-term contracts, but have permanent employment agreements with the Company.

COMPANY SECRETARY

The company secretary is accountable to the Board.

During the year under review, the company secretary provided guidance to the directors in terms of their duties, responsibilities and powers and their responsibilities and liabilities under the Companies Act. The Board was made aware of changes to any relevant law affecting the Company. The company secretary disclosed the corporate actions, SENS announcements and directors’ dealings in securities and ensured compliance with the JSE Listings Requirements and the Companies Act.

The Board has considered the competence, qualifications and experience of the new company secretary and is satisfied that they are appropriate. This was concluded after due assessment following a review by the remuneration committee of the Company regarding the company secretary’s qualifications, experience and performance to date. All directors have unlimited access to the services of the company secretary.

The company secretary’s appointment and removal is a matter for the whole Board.

The Board is satisfied that an arm’s length relationship exists between the company secretary and the Company, as he is not a member of the Board, is not involved in the day-to-day operations of the Company and is not a prescribed officer.

CHANGES TO THE BOARD AND COMPANY SECRETARY

During the year under review, Mr S Young did not make himself available for re-election as a member of the Board or committee member at the AGM held on 21 February 2018. Mr AM Salie was appointed to the Board as an executive director on 21 February 2018 in the capacity of the chief investment officer, and Advocate Dr Ngoako Ramatlhodi was appointed on 7 March 2018 as a non-executive director. As a result of the changes to the Board, the committees were reconstituted accordingly.

The following change was made post the financial period:

The company secretary, Ms Nobulungisa Mbaliseli was the company secretary and secretary to all the committees, resigned on 3 September 2018. Mr Damien Terblanche was appointed as the new company secretary to the Board and committees, effective 4 September 2018.

BOARD COMMITTEES

The Board has the following committees in place to assist it in executing some of its duties:

- Executive committee

- Nomination committee

- Audit and risk committee

- Remuneration committee

- Social, ethics and transformation committee

- Investment committee

NUMBER OF MEETINGS HELD DURING THE YEAR

| Board | 4 |

| Audit and risk committee | 3 |

| Remuneration committee | 3 |

| Investment committee | 3 |

| Nomination committee | 1 |

| Social, ethics and transformation committee | 2 |

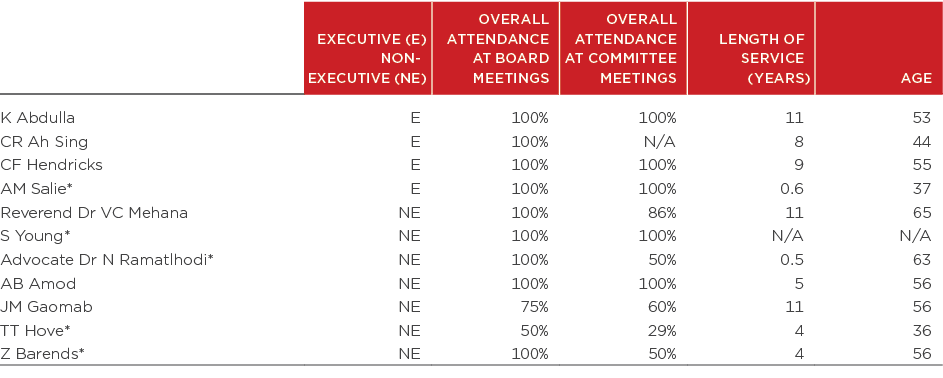

DIRECTORS’ DETAILS AND ATTENDANCE AT MEETINGS

| * | The above includes Mr Young’s attendance who did not make himself available for re-election at the AGM on 21 February 2018. It takes into account Mr Salie’s attendance since his appointment at the AGM on 21 February 2018, and Advocate Dr Ramatlhodi’s attendance since his appointment on 7 March 2018. |

| * | It does not take into account the appointment of Mr TT Hove as chairman of the remuneration committee nor Ms Z Barend’s appointment to the nomination committee as these appointments were made post the last committee meetings. |

EVALUATION OF THE BOARD, COMMITTEES AND INDIVIDUAL DIRECTORS

Ever-changing issues facing companies make it essential to look at the agenda items of the Board to ensure that it stays aligned with good governance and ethics, and also meets current needs, best practices and matters of strategic importance. The independence of directors and their other commitments are also evaluated.

The Board and committees were evaluated by its members using an electronic Appraisal Instrument. Having regard to the findings, it was concluded that the Board and committees operate efficiently, openly, transparently and there is a good level of discussion between members and attendees. The findings addressed some areas for improvement which will be addressed appropriately.

GENDER AND RACE DIVERSITY POLICIES

- Gender diversity policy: During the prior financial year, the Board adopted and approved a gender diversity policy which includes identifying suitable candidates for appointment to the Board. The committee will consider candidates on merit against objective criteria and with due regard to the potential benefits of gender diversity at Board level. The committee will continue to discuss and annually agree on all measurable targets in terms of gender diversity on the Board.

- Race diversity policy: During the year under review the Board adopted and approved a race diversity policy as the Company believes that race diversity at Board level maximises opportunities to achieve its business goals through an informed understanding of the diverse environments in which we operate. The committee will assess the composition and recommend the appointment of directors as a truly diverse Board which will include the differences in age, gender, race, skills and industry experience and other distinctions between directors. The selection of Board members is made on merit, in the context of their skills, experience, independence and knowledge, which the Board as a whole requires to be effective. The committee will consider candidates on merit against objective criteria and with due regard to the potential benefits of race diversity at Board level. The committee will continue to discuss and annually agree all measurable targets in terms of race diversity on the Board.

EXECUTIVE COMMITTEE

The role of the executive committee is to advise the chief executive officer and the other members on the decisions for which they are individually accountable. The executive committee provides input and recommendations to support the chief executive officer in exercising their authority delegated by the Board to run the business of the Group.

- Key focus areas of the executive committee:

- Developing the Group’s strategy and budget for the Board’s approval

- The day-to-day operations of the Company

- Executing the strategic plan once agreed by the Board

- Assuming overall responsibility for the growth and performance of the Group

- Providing assurance to the Board in relation to the overall performance and risk management

- The custodian of good corporate governance

- Providing strategic guidance and input to the subsidiaries in the Group

- Monitoring and managing the capital requirements and allocating and investing its resources

- Responsible for the investment portfolio of the Company

- Ensuring that the Company is a respected corporate citizen

- Receives reports, plans and provides input to subsidiaries in the Group

The Board is satisfied that the executive directors and their teams are adequately resourced and equipped to effectively manage the Group.

NOMINATION COMMITTEE

The nomination committee comprises three non-executive directors. Reverend Dr VC Mehana is the chairman and Mrs AB Amod and Ms Z Barends are members. The committee met once during the year under review to assist the Board with the appointment of new directors by making recommendations with due regard to gender and race diversity.

At the AGM on 21 February 2018, Mr S Young did not make himself available for re-election and Mr Abdul Malick Salie was appointed as an executive in the capacity of the chief investment officer. Advocate Dr Ngoako Ramatlhodi was appointed as a lead independent non-executive director on 7 March 2018.

Due to Mr Young’s non-availability for re-election as a director, the Board reconstituted the committees as Mr Young’s position as a committee member became vacant and the following appointments were made to committees:

- Ms Z Barends was appointed to the nomination committee

- Mr TT Hove was appointed as the chairman of the audit and risk and remuneration committees

- Advocate Dr NA Ramatlhodi was appointed as a member of the audit and risk and the investment committees

- Mr AM Salie was appointed as a member of the investment committee

The full report by the nomination committee containing details of how the committee discharged its duties and responsibilities can be found on pages 20 to 21 of the full corporate governance report.

AUDIT AND RISK COMMITTEE

The audit and risk committee comprises three independent non-executive directors and one lead independent non-executive. Mr TT Hove is the chairman and the members are Mrs AB Amod, Mr JM Gaomab and Advocate Dr NA Ramatlhodi. The committee met three times during the year under review. The executive committee, external auditor, internal auditor and advisor attend by invitation and do not form part of the decision-making process of the audit and risk committee.

Risk management – The Board has delegated the management of risk to the audit and risk committee. The Board is committed to effective risk management in pursuit of the Group’s strategic objectives with the aim of growing shareholder value sustainably. The Board understands that proactive risk management is both an essential element of good corporate governance and an enabler in realising opportunities and continues to enhance its capabilities to anticipate risks and manage them.

Technology and information governance – The Board is responsible for technology and information governance in the Group and delegated the management of technology and information governance to the audit and risk committee to ensure the promotion of an ethical technology and information governance culture and awareness.

Expertise and experience of the chief financial officer and the finance function – The audit and risk committee satisfied itself in terms of paragraph 3.84(g)(i) of the JSE Listings Requirements that the Group CFO and the finance function have the appropriate expertise and experience and are adequately resourced.

The audit and risk committee is responsible for the oversight of risk management and technology and information. The role, responsibilities and focus areas for the year under review are comprehensively addressed in the audit and risk committee report on pages 22 to 27 of the full corporate governance report.

For the year under review, the committee is satisfied that is has fulfilled all its statutory duties assigned by the Board in terms of the board-approved charter. The chairman of the audit and risk committee reports to the Board on the activities of the committee at each Board meeting.

REMUNERATION COMMITTEE

The remuneration committee comprises three independent non-executive directors. Mr TT Hove is the chairman and the members are Mrs AB Amod and Reverend Dr VC Mehana. The chief executive officer and external advisor attend by invitation and do not form part of the decision-making process of the remuneration committee. The remuneration committee met three times during the year under review.

The role, responsibilities and focus areas for the year under review are comprehensively addressed in the remuneration committee report and in the full corporate governance report.

For the year under review, the committee is satisfied that it has fulfilled all its statutory duties assigned by the Board in terms of the board-approved charter. The chairman of the remuneration committee reports to the Board on the activities of the committee at each Board meeting.

SOCIAL, ETHICS AND TRANSFORMATION COMMITTEE

The social, ethics and transformation committee comprises three independent non-executive directors and one executive director. Mrs AB Amod is the chairman and the members are Ms Z Barends, Mr JM Gaomab and Ms CF Hendricks. Members of the executive committee and the human resources department attend by invitation and do not form part of the decision-making process of the social, ethics and transformation committee. The committee met twice during the year under review.

The committee is committed to sustainable development and is therefore responsible for ensuring that the Group conducts its operations in a manner that meets existing needs without compromising the ability of future generations to meet their needs. The committee’s primary role is to support, advise and guide management’s efforts in respect of sustainable development, social and ethics matters, transformation, and to ensure that the Group is seen to be a responsible corporate citizen.

One of the main purposes of the committee is to ensure compliance with the amended B-BBEE Codes of Good Practice and to measure the Company in terms of compliance with the Department of Trade and Industry’s Code of Good Practice, the JSE Listings Requirements and the B-BBEE Commission. As a responsible employer, the Group adhered to all labour legislation. Transformation goes beyond compliance with B-BBEE and is embedded in the Group’s culture, ethics and values.

The committee has oversight of the Group’s corporate social investments and social and economic development programmes.

The role, responsibilities and focus areas for the year under review are comprehensively addressed in the social, ethics and transformation committee report on pages 49 to 54 of the full corporate governance report.

For the year under review, the committee is satisfied that it has fulfilled all its statutory duties assigned by the Board in terms of the board-approved charter. The chairman of the social, ethics and transformation committee reports to the Board on the activities of the committee at each Board meeting.

INVESTMENT COMMITTEE

The investment committee comprises three independent non-executive directors and two executive directors. Reverend Dr VC Mehana is the chairman and the members are Messrs K Abdulla, AM Salie and TT Hove and Advocate Dr NA Ramatlhodi. Members of the executive committee attend by invitation and do not form part of the decision-making process of the investment committee. The committee met three times during the year under review.

The committee has an independent role, operating as an overseer and making recommendations to the Board for its consideration and final approval in terms of investment opportunities. Investments are adjudicated to ensure it has both a strategic fit with synergistic benefits to the current level of return with a reasonable payback period based on the specific industry.

The committee is well balanced with essential legal, financial and strategic expertise.

The role, responsibilities and focus areas for the year under review are comprehensively addressed in the investment committee report on pages 55 to 58 of the full corporate governance report.

For the year under review, the committee is satisfied that it has fulfilled all its statutory duties assigned by the Board in terms of the board-approved charter. The chairman of the investment committee reports to the Board on the activities of the committee at each Board meeting.

REPORTING TO STAKEHOLDERS ON STRATEGY AND PERFORMANCE

The Group’s strategy and performance are covered comprehensively in the reports of the chairman, chief executive officer and the group financial officer.

AEEI appreciates the role of its stakeholders and remains committed to nurturing impactful relationships that deliver mutual benefits and encourage transparent, objective and relevant communication. The Group recognises that its businesses are one of the stakeholders in the socio-economic and environmental system. It is essential for the Group to compete successfully in an increasingly complex and ever-changing business environment and to systematically bring about the change needed for sustainable development. We built and maintained trust and respect with our various stakeholders, thus ensuring a positive impact on our reputation.

AEEI places great value on its high standards of ethics, communication, transparency of information in terms of the Promotion of Access to Information Act, Protection of Personal Information Act, 2013, and other regulations and directives relating to the dissemination of information.

The Company has identified stakeholder groups with whom it engages in a structured manner. Refer to key stakeholders for full details.

We addressed essential risks and opportunities and responded timeously and appropriately to issues raised in our interactions with our various stakeholders. (King IV™ – Principle 16)

GOVERNANCE MATTERS

The system of internal control is designed to ensure that significant risks are appropriately identified, managed and provide reasonable assurance that the Board can delegate risk management to the audit and risk committee. AEEI places great value on its high standards of corporate governance, ethics, communication and transparency of information in terms of the Promotion of Access to Information Act and other regulations and directives relating to the dissemination of risk with its stakeholders

Risk management – A key component of the audit and risk committee was to review the top risks that the Group faces in order to respond to new and emerging risks and to ensure alignment with regulatory changes as well as best practice. In doing so, the committee took into account stakeholder needs, corporate governance principles, risk trends, global trends and external dynamics. Refer to page 28 for the full risk management report.

Compliance – The audit and risk committee is responsible for reviewing the compliance with legal, regulatory, codes and other standards and continually monitors the implementation of the legal compliance processes. The audit and risk committee is satisfied that it has complied with all its legal, regulatory and other responsibilities during the year under review. (King IV™ – Principle 13)

Group internal audit – The Group internal auditor performs an independent assurance function. The Group internal auditor had unrestricted access to the Group chief executive officer, chief financial officer and the chairman of the audit and risk committee.

The primary objective of the Group internal auditor during the year was to provide independent objective assurance and consulting activity on the adequacy and effectiveness of the Group’s systems of governance, risk management and internal control and reports functionally to the audit and risk committee. The audit and risk committee monitored the effectiveness of the internal audit function in terms of its scope, independence, skills and competence, execution of its plan and overall performance.

The Group internal auditor recommended the annual internal audit plan for approval to the audit and risk committee. The audit and risk committee approved the formal internal audit plan, which included risk-based audits and operational audit reviews of the Group’s governance and business processes for 2018.

The role, responsibilities and focus areas for the year under review are comprehensively addressed in the audit and risk committee report on pages 24 to 25 of the full corporate governance report.

For the year under review, the committee is satisfied that it has fulfilled all its statutory duties assigned by the Board in terms of the board-approved charter. The chairman of the audit and risk committee reports to the Board on the activities of the committee at each Board meeting.

STAKEHOLDER RELATIONSHIPS

The Group subscribes to a policy of full, accurate and consistent communication with regard to all its affairs. The Board seeks to present a balanced and understandable assessment of the Group’s position at all times when reporting to stakeholders. The integrated report deals adequately with disclosures relating to financial statements, auditors’ responsibility, accounting records, internal controls, risk management, accounting policies, adherence to accounting standards, going concern issues, as well as the Group’s adherence to established codes of governance.

The role, responsibilities and focus areas for the year under review are comprehensively addressed in the stakeholders’ relations report – Building relationships with our stakeholders.

ENGAGING WITH OUR STAKEHOLDERS

The Group’s stakeholder engagement is governed by the recommendations of King IV™. AEEI has a stakeholder engagement framework, which includes communication guidelines and corporate identity. AEEI’s stakeholder engagement framework outlines the Company’s approach to communicating and working with its stakeholders. Engagement is an integral part of developing an understanding of our stakeholders’ needs, interests and expectations and assists with strategic and sustainable decision-making.

Stakeholder consultation and relationship management are implemented in all divisions of the Group. Our stakeholders’ expectations are identified through regular engagements, personal interactions and our financial and sustainability reports. The Board appreciates that it is required to provide timeous, relevant and accurate information and continually strives to maintain open direct dialogue with all its stakeholders.

AEEI regularly communicated with its stakeholders during the year under review, which included the presentation of the Group’s strategy and performance. Engaging with stakeholders is decentralised and forms part of the operations of our various business units. Each business unit is required to report regularly on its stakeholder engagements. For further information refer to building relationships with our stakeholders. (King IV™ – Principle 16)

This statement shows the total value created and how it was distributed.

RESPECTED CORPORATE CITIZENSHIP

The Board and management recognise that AEEI is an economic entity as well as a corporate citizen and that it has a social and moral standing in society with all the attendant responsibilities. Further information is provided in our corporate social investment report. (King IV™ – Principle 3)

ASSURANCE REPORT

As an investment holding company, AEEI does not require assurance in respect of any reports other than its financial statements. Such assurance is provided by the Group’s external auditors, BDO Cape Inc.

APPLICATION OF AND APPROACH TO KING IV™

In supporting King IV™ the Board recognises that it is the custodian of corporate governance for the Company and ensured that directors:

- lead ethically and effectively;

- supported an ethical culture;

- set the strategic direction for the Group for the year ahead;

- approved policies and planning; and

- administered and monitored the Group’s risks and opportunities, strategy, business model, performance and sustainable development.

The Board ensured compliance with applicable laws, rules, codes and standards in a way that supported the Group in being ethical and a good corporate citizen. It ensured that remuneration is fair and transparent and that the integrity of information for decision-making internally and externally was assured. A stakeholder-inclusive approach was applied in the Group to ensure that the needs, interests and expectations of material stakeholders were addressed.

A statement on AEEI’s application of the principles of the King IV™ is available on www.aeei.co.za.

AEEI has applied all the principles of King IV™.

2018 VALUE DISTRIBUTION

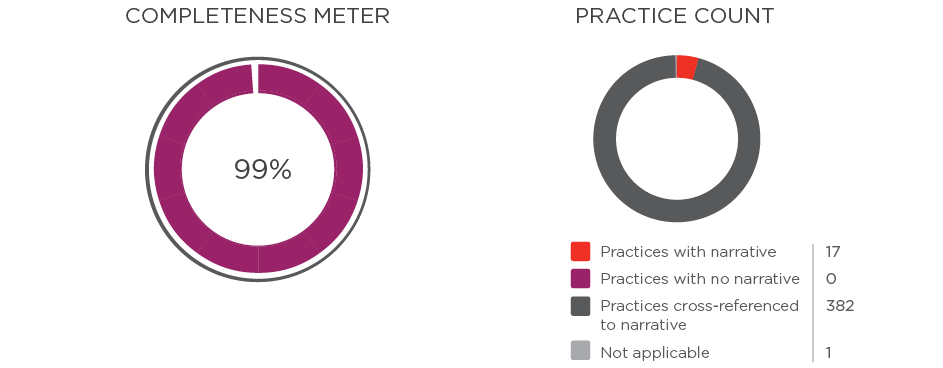

King iv™ REPORT WRITER – detailed by practice

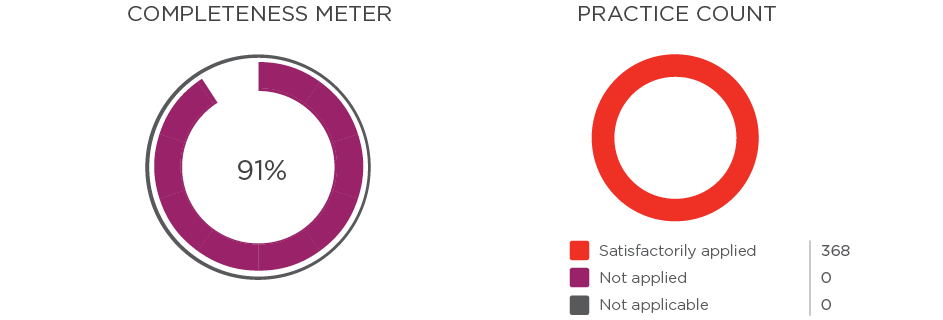

King iv™ management review

King iv™ REPORT WRITER – by principle

CORPORATE GOVERNANCE STRUCTURE

Click on the image below to view the PDF.

OUR EFFECTIVE LEADERSHIP

In terms of AEEI’s Memorandum of Incorporation and Board Charter, the Board is responsible for strategic direction and ultimate control of the Company.

| FRONT (left-right) | Cherie Felicity Hendricks, Zenariah Barends, Chantelle Ah Sing, Aziza Begum Amod |

| BACK (left-right) | Abdul Malick Salie, Takudzwa Tanyaradzwa Hove, Reverend Dr Vukile Charles Mehana, |

INTRODUCING OUR BOARD OF DIRECTORS

The diversity and skills of our Board ensure that the Group is steered to deliver growth to all our stakeholders.

Executive directors

Chief executive officer

Khalid Abdulla (53)

MBA (UCT), BCompt (Hons), CTA (Unisa), Project Management (UCT)

Appointed: 29 August 2007

Nationality: South African

Board committee:

Investment committee

Expertise and experience: Mr Abdulla is the Group chief executive officer (CEO) of AEEI and has been with the Group since 1999. He served as the CEO of various subsidiaries, i.e. the information technology and financial services businesses and as Group chief financial officer (CFO) in 2007 before being appointed as Group CEO in November 2009.

Mr Abdulla has been appointed to and serves on various boards, committees and non-governmental organisations (NGOs). He has more than 30 years’ commercial experience related to fishing, technology, health, biotherapeutics, events and tourism and financial services. He is a regular invitee to and participant at the World Economic Forum in Africa as well as the Summer Davos in China. He was a speaker for the Department of Trade and Industry at conferences in the United Kingdom and Germany for “Investing into South Africa”.

Mr Abdulla is the recipient of many awards, including the Global Leadership Excellence Award presented at the World Leadership Congress and Awards which took place in Mauritius; overall winner of the Inaugural South African Vision 2030 Future Maker: Driver for Change 2017 Award; and the overall winner at the Oliver Empowerment Awards as SA’s most Empowered Business Leader of the Year (2017). Financial Mail voted him as one of the best CEOs in the country in 2016 and also ranked him among the 10 best executives of 2015. Mr Abdulla was the recipient of the prestigious Black Business Executive Circle/Absa Bank Kaelo Award for giving guidance and leadership to grow junior and middle management.

Chief FINANCIAL officer

Chantelle Rae Ah Sing (44)

BCom (Nelson Mandela University), Post-graduate diploma in Accounting (University of KwaZulu-Natal)

Appointed: 19 November 2009

Nationality: South African

Expertise and experience: Ms Ah Sing is the Group CFO of AEEI and was appointed to the AEEI Board as an executive director in November 2009. She joined the Group in 2007 under the health and biotherapeutics divisions, where she was promoted to the role of financial director.

She has more than 15 years’ experience in the commercial sector and held various operational and financial management positions within various industries including service, manufacturing, healthcare and biotechnology after she qualified as a chartered accountant.

CORPORATE AFFAIRS AND SUSTAINABILITY DIRECTOR

Cherie Felicity Hendricks (55)

University of Cambridge Programme for Sustainability Leadership, Incite Sustainability Executive Programme, Executive Women in Leadership Programme (University of Cape Town – Graduate School of Business)

Appointed: 18 March 2009

Nationality: South African

Board committees:

Social, ethics and transformation committee

Expertise and experience: Ms Hendricks is the corporate affairs and sustainability director responsible for corporate affairs, which include sustainability, regulatory compliance, corporate social investment and Group communication. With more than 19 years of experience at the Group and an in-depth knowledge of the corporate and investment sectors, she currently sits on the boards of the Group’s major investments and links the Group’s subsidiaries with the Group’s corporate office.

Ms Hendricks oversees corporate governance across the Group. Her portfolio includes writing of policies and procedures and keeping abreast of regulatory changes, ensuring good corporate governance practices are adhered to and assisting with the governing of ethics. She ensures compliance with the JSE Listings Requirements, Companies Act and King IV™. She is accountable for sustainability, transformation and social responsibility programmes and develops plans and executes the Group’s corporate affairs strategy. She oversees the building of the Group’s brand and ethos and mentors and oversees the internal and external communication, supervises the marketing, investor relations and public relations activities within the Group. She manages the human resources department ensuring that fairness and ethical standards are upheld and is a primary contributor to the company secretarial department. She is the recipient of numerous prestigious awards, including CEO’s Award for Excellence in Management, Chairman’s Award for Loyalty Services and Dedication, Long Service Award and won the Highest Sustainability Data Transparency Index twice – in the Financial Services Sector by the Integrated Reporting Assurance Services out of more than 300 Top JSE-listed companies.

CHIEF INVESTMENT OFFICER

Abdul Malick Salie (37)

BCom (Hons), CA(SA)

Appointed: 21 February 2018

Nationality: South African

Board committees:

Investment committee

Expertise and experience: Mr Salie brings expertise in commercial and financial disciplines. He has more than 15 years’ experience holding numerous directorships in the financial and information technology sectors. Mr Salie holds office as the chief investment officer of AEEI and served employment in various operational and financial roles in multinational groups such as Vodacom, Pioneer Foods and the Naspers Group. He also has extensive local and international experience in audit and regulatory environments.

Non-executive board members

Independent non-executive chairman

Reverend Dr Vukile Charles Mehana (65)

PhD (University of Johannesburg), DBA, Honoris Causa (Commonwealth University), MBA (De Montfort University, UK), Master Class Certificate (London Graduate School), BTh (Rhodes University), AMP (Insead Business School, France), Certificate in Public Enterprises (National University of Singapore), DPhil (University of Johannesburg), Top Management Certificate on Public Enterprise (National University of Singapore)

Appointed: 8 August 2007

Nationality: South African

Board committees:

Chairman of the investment committee Chairman of the nomination committee Remuneration committee

Expertise and experience: Reverend Dr Mehana is an ordained Minister of the Methodist Church. He has also been appointed by the Minister of Higher Education to the Governing Council of the University of KwaZulu-Natal (UKZN) and he is the Chair of Council.

Reverend Dr Mehana is a former Adjunct Professor and part-time lecturer of Business Strategy at UCT Graduate School of Business, where he taught Business Strategy course to the AIM Programme, Change Management to Diploma and assisted with the Business Leadership for MBA students.

Reverend Dr Mehana is also one of the 40 Social Cohesion Advocates under the Ministry of Arts and Culture.

LEAD INDEPENDENT NON-EXECUTIVE DIRECTOR

Advocate Dr Ngoako Abel Ramatlhodi (63)

BA Law and LLB (National University of Lesotho), MSc in International Relations (University of Zimbabwe), admitted to the Bar of Lesotho and South Africa as an Advocate, Honorary Doctor of Law Degree (University of Limpopo)

Appointed: 7 March 2018

Nationality: South African

Board committees:

Audit and risk committee

Investment committee

Expertise and experience: Advocate Dr Ramatlhodi is an experienced businessman, lawyer and advocate. He was the Premier of Limpopo and held the positions of Minister of Public Services, Minister of Mineral Resources and Deputy Minister of Correctional Services and was a member of the South African Parliament. Advocate Dr Ramatlhodi is a founder member and the first chairman of the University of the North Arts and Drama Association and chairman of the Central Cultural Committee. He lectured Public International Law at the University of the North.

Advocate Dr Ramatlhodi maintains board positions in a number of other companies.

Independent non-executive director

Johannes Mihe Gaomab (56)

Appointed: 13 September 2006

Nationality: Namibian

Board committees:

Audit and risk committee

Social, ethics and transformation committee

Expertise and experience: Mr Gaomab is an international businessman with major business interests in Namibia and South Africa. He is the founder and chairman of Gaomab Investments Management CC, Gulf Oil Marine (Pty) Ltd, Namibia Atlantic Petroleum and Shipping Corporation and the executive chairman of African Renaissance Mining Company (Pty) Ltd, a South African company with subsidiaries in Namibia, the Democratic Republic of the Congo, Malawi and Zambia.

Independent non-executive director

Aziza Begum Amod (56)

Appointed: 12 November 2012

Nationality: South African

Board committees:

Chairman of the social, ethics and transformation committee

Remuneration committee

Nomination committee

Expertise and experience: Ms Amod is a professional director, businesswoman, philanthropist and entrepreneur with more than 30 years of business experience in the retail sector. She provides consultancy to women-owned businesses in the areas of impact investment, social innovation and technology applications for social impact in the food and retail sector.

Ms Amod has been featured and published in numerous articles in relation to business and female entrepreneurs. She is a well-known philanthropist supporting a number of NGOs, outreach programmes and serves on the board of trustees of numerous philanthropic associations. She currently serves as a director and trustee on various business entities and trusts.

Independent non-executive director

Takudzwa Tanyaradzwa Hove (36)

BCom (Hons) Accounting (Nelson Mandela University) CA(SA), ACMA, CGMA

Appointed: 4 September 2013

Nationality: Zimbabwean

Board committees:

Chairman of the audit and risk committee

Chairman of the remuneration committee

Investment committee

Expertise and experience: Mr Hove worked for AEEI from April 2009 until September 2013 and held several positions, including Group financial manager and corporate finance executive. He has in-depth knowledge of the Group’s diverse operations, having worked closely with the operational heads of the Group’s businesses. He is currently an executive director of Independent Media (Pty) Ltd.

Independent non-executive director

Zenariah Barends (56)

Diploma in Library and Information Science, BA (Hons) (University of the Western Cape)

Appointed: 14 November 2014

Nationality: South African

Board committees:

Nomination committee

Social, ethics and transformation committee

Expertise and experience: Ms Barends is the chairperson, trustee and board member of a number of civil society institutions including Inyathelo: The South African Institute for Advancement. She has a long history of involvement in arts and culture through the Cape Cultural Collective as well as a strong track record in human rights activism.

She served as the Western Cape Head of Investigations of the Truth and Reconciliation Commission, chaired by Nobel Laureate, Archbishop Desmond Tutu.

In her current portfolio, Ms Barends is chief of staff at Independent Media (Pty) Ltd. She was appointed as a senior executive at Sekunjalo Investment Holdings (Pty) Ltd in 2017. Her portfolio includes coordinating the involvement of the Sekunjalo Group in the BRICS Business Council, where she has also served as the Chief Secretariat of the South African Chapter of the BRICS Business Council. She is also responsible for coordinating the Sekunjalo Group’s various World Economic Forum activities, which include the Sekunjalo Group’s involvement in the Global Agenda Council on Emerging Multinationals and the Global Growth Companies Advisory Board.

OUR EXECUTIVE TEAM

CHIEF EXECUTIVE OFFICER

Mr Khalid Abdulla is the CEO of the Group and is an executive director appointed by the Board.

During the year under review he was responsible for leading the implementation and execution of the approved strategy, policy and operational planning. He served as the chief link between management and the Board and is accountable to the Board.

He is responsible for aiding the achievement of performance goals, objectives and targets as well as maintaining an effective management team and management structures. He continued with the implementation of the Group’s Vision 2020 Vision strategy as approved by the Board. He reviewed the annual business plans and budgets that support the Company’s long-term view and made recommendations thereon. He ensured that the appropriate policies were formulated and implemented to guide activities across the Group and ensured effective internal organisation and governance measures were deployed.

A succession plan is in place for the CEO in the event of unplanned leave or planned resignation. (King IV™ – Principle 10)

CHIEF FINANCIAL OFFICER

Ms Chantelle Ah Sing is the CFO of the Group and is an executive director.

During the year under review she assisted the Board to protect and manage the Company’s financial position with the assistance of the audit and risk committee. She supervises and reviews the financial statements to ensure that they are fairly presented and contain the proper disclosures. She plays the overseer role to ensure the appropriate internal controls and regulatory compliance policies and processes are in place and that non-financial aspects relevant to the business of the Company were identified.

The audit and risk committee has considered the expertise and experience of the CFO and deems it appropriate. The audit and risk committee has considered and is satisfied that the finance department has the appropriate expertise and is adequately resourced. (King IV™ – Principle 10)

CORPORATE AFFAIRS AND SUSTAINABILITY

Ms Cherie Hendricks is the corporate affairs and sustainability director and is an executive director.

During the year under review, she ensured an effective ethical culture and that corporate governance is maintained in the Group. She reported to the Board on social and economic development, B-BBEE, sustainable development, transformation and good corporate citizenship, with the emphasis on corporate social responsibility. She is accountable for sustainability, transformation and social responsibility programmes and develops plans and executes the Group’s corporate affairs strategy.

She ensured regulatory compliance with the JSE Listings Requirements, Companies Act and King IV™. She wrote new policies and procedures, updated existing policies and procedures and also updated Board policies and charters in compliance with statutory, regulatory and legislative requirements for adoption and approval by the Board. She ensured that good corporate governance practices are adhered to and assisted with the governance of ethics. She ensured that stakeholder relationships and stakeholder engagement activities, consumer relationships, including public relations and marketing, were managed effectively.

She manages the human resources department ensuring that fairness and ethical standards are upheld and is a primary contributor to the company secretarial department. She ensured that the human resources function and employment activities were aligned with Group policies.

She is responsible for writing the integrated report, the notice of the annual general meeting and form of proxy to the shareholders and ensured the timeous delivery thereof. (King IV™ – Principle 10)

CHIEF INVESTMENT OFFICER

Mr Abdul Malick Salie is the chief investment officer (CIO) and an executive director.

The CIO is responsible for carrying out the duties as delegated by the investment committee. The main role of the position includes having a firm understanding of the Group’s broad growth strategy – organic and acquisitive; leading the Group’s investment strategy by providing recommendations of suitable investments; and preparing and submitting executive reports to management, the Board and clients. The CIO must maintain a broad understanding of and ensure continued development of all market securities plans to ensure satisfactory management of the Group’s investment portfolio, and must also explore innovative and new approaches to the investment process as well as strategies for generating desirable returns for all stakeholders.

During the year under review Mr Salie developed and maintained an efficient relationship with the investment committee; ensured compliance with all policies and laws while monitoring the Group’s current investments; and ensured operational efficiency across all Group entities using sound business development techniques.

He analysed the performance of the Group’s investment portfolio and presented recommendations for additional investment opportunities and potential acquisitions to the investment committee. All recommendations were based on thorough research as well as in-depth quantitative and qualitative assessments of the businesses. Investment opportunities spanned across all AEEI’s current segments and were selected based on the entities being key strategic fits within their relevant segments as well as offering future synergistic growth within the Group. All of the investment opportunities that arose were documented and analysed by preparing regular investment reports and reviews, including quantitative and qualitative portfolio studies. He reviewed quarterly financial statements and remained up to date with important valuation and policy changes.